Marc Stein is the founder and CEO of Underwrite.ai. Underwrite.ai applies advances in artificial intelligence derived from genomics and particle physics to provide lenders with non-linear, dynamic models of credit risk which radically outperform traditional approaches.

Prior to Underwrite.ai, Marc founded College Loan Market, the first auction platform for student lending; cofounded LeaseQ, a marketplace for equipment leasing; served as CTO for CollegePublisher and Y2M Networks; CTO for Alumni Loan Consolidation Program and Student Loan Consolidation Program; and as an SVP and CTO at JP Morgan Chase Education Finance.

Archives: team-member

member news and reviews

Paul Heirendt

Paul Heirendt co-founded an early Blockchain Identity Management platform CyberDeadbolt which was acquired in 2017. Paul has now founded BLOCK id(TM) to provide Digital Identity Management, Rights Management & Security for sensitive information and smart contracts. A serial entrepreneur with more than 30+ years of experience in technology, publishing and healthcare business management, business development and Internet business definition.

Founder of BLOCK idTM a Blockchain based Identity Management & Rights Management platform using Machine Learning, AI, and Distributed Ledger Technology to enable applications and developers to add Blockchain functions to existing or new platforms and applications.

Co-Founder of CyberDeadbolt (2016) a Blockchain based identity management platform acquired by Rivetz Corp. in December 2017.

Joshua Greenwald is the founder and CEO of LXDX, a digital asset exchange built to institutional standards. For over a decade Joshua has been head-of-desk and/or a major participant in algo-trading businesses, including leading an equities group at DRW before heading up KOSPI trading and running research for Asia. He founded Greenlight Trading in the Americas and later ran high frequency for Laurion Capital Shanghai. Immediately before launching the LXDX platform, Joshua worked on automation and propulsion at SpaceX.

Ronald Ingram

Ronald is the Founder and CEO of ECHO Payment Systems Inc.- an award-winning FinTech innovation company based in Henderson, NV with operations throughout North America. Ronald is a serial entrepreneur and self-taught polymath. His focus for the last 20 years has been financial services and mobile banking technology. He started his career with a large investment banking firm and progressed into roles in commercial banking and technology at BMO and banking systems at TD Bank. He holds multiple patents and is a Director of companies in AI, neobanking, and FinTech. He is the Founding President of Beanstream.com which processes over $30 billion in transactions annually and has been advising Fortune 500 and Big 5 Management Consulting firms since 2005 on trends and investments in financial technology and banking.

Craig is a proven Enterprise Risk Management expert with an established track record of driving enterprise-wide initiatives for the world’s top financial institutions. Leverages vision, leadership, innovation, and relationship management skills to achieve success. Expertise in leading global initiatives to align risk management practices with business goals.

RiskTao, LLC – Craig is the CEO & Founder of RiskTao, LLC which specializes in Enterprise Risk Training and Advisory Services. Craig has conducted risk training classes, presented and chaired major industry risk conferences for both Incisive Media and The Center for Financial Professionals. Craig is also advising several start-ups in the Fintech space focusing in the mobile wallet space and other forms of electronic payments.

First Data – Craig is the Former Global Head of Enterprise Risk Management Strategy and was responsible for developing and implementing the ERM Framework Elements, Integrating Risk Management into the Business Strategy, executing Top Risk Assessments, developing and driving the RCSA and Scenario Analysis Programs, ERM Training, Bank Sponsorship Risk Analysis, collecting and reporting External Events and leading the ERM Technology Program’s Strategy and Architecture.

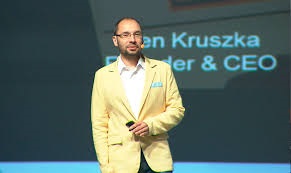

Ken Kruszka

Ken Kruszka, Founder & CEO of SnapCheck, is a FinTech and payments pioneer. During his 15+ years in FinTech, Ken has led the creation of numerous firsts, including:

First mobile remittance service in the US

First global mobile bank account

And he was the first person to send $1 around the world by mobile

With SnapCheck, Ken is dedicated to eliminating paper checks and helping businesses across the digital divide and join the world of electronic payments. In addition, Ken is a member of the Fed Improvement Project: The Business Payments Coalition.

SnapCheck is driving the elimination of paper checks, saving organizations 65% or more in payment costs and mitigating 90% of payment fraud.

Cyrielle Chiron

Cyrielle Chiron is Managing Director, North & Latin America for global FS intelligence specialist RFi Group and is responsible for all research programs, sales & operations across North and Latin America.

Cyrielle offers a wealth of payments, retail and commercial financial services knowledge and deep research experience across both quantitative and qualitative research. She is a regular speaker at thought leadership events across the USA, Canada, Europe, Asia

and

Australia.

Cyrielle is also Editor of the Canadian Banker, a monthly e-magazine which focuses on thought leadership, insights

and

product news and a regular contributor to the

RFi

Group Podcast ‘Global Digital Banker’.

David Galvan

David Galvan is a payments, technology and internet veteran, with over 25 years of business and operating experience in Silicon Valley. He is currently VP of Business Development and Strategic Alliances for MasterCard International, where he focuses on digital partnerships, relationships and investments with emerging companies in the Fintech space. Prior to that, Galvan was Senior Vice President of Business Development and Strategy for 24 Hour Fitness, the largest privately owned U.S. fitness club chain in the United States, serving nearly four million members in more than 420 clubs. Galvan was hired by Private Equity firm Forstmann Little to prep the Company for sale after a failed attempt in 2012. Galvan oversaw business and operational management of the 24HF Personal Fitness Business, Retail Business, Corp/Healthcare Sales, Sponsorship Sales, and Real Estate Development, Team. He was also responsible for all new and legacy deals and strategic partnerships for entire Company. 24 Hour Fitness was successfully sold to an investor group led by AEA Investors for $1.85B in June 2014, after which the Forstmann Little team sold their stakes and left the organization.

Gururaj Balakrishna

United Company for Financial Services, Chief Operating Officer (Aug 2018 – present)

‒ Co-founder and COO of a Fintech start-up in Saudi Arabia. In the process of launching a first of its kind Consumer lending NBFC which is expected to launch operations in May. Will be responsible for the entire Operations, Underwriting, Analytics, Collections and Customer Service functions

Dunia Finance LLC, Chief Credit Officer, and Acting Chief Risk Officer (between Sep 2016 and Jan 2018) (January 2007 – Aug 2018)

Somaskandan Jayaraman

An innovative thought leader and disruptor with global experience and perspective, Somaskandan is a young, goal-oriented go getter with a vision to maximise value of the entity he associates with.

Somaskandan is an MBA with honours from the reputed IE Business School in Madrid, Spain, which is ranked amongst the top five b-schools worldwide. He is also a business graduate from Kingston University, London and is certified in Risk Management and Public Finance from London School of Economics (LSE).