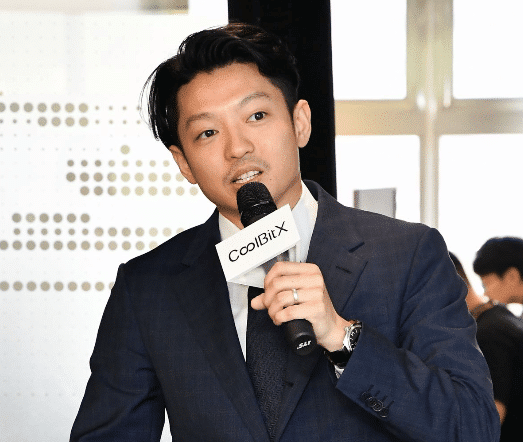

Michael Ou, is a FinTech entrepreneur who devotes his time in the development of blockchain security. Specializing in the innovative use of blockchain technology and smart cards, Michael was awarded and recognized over time for his contribution in the industry – 2015 Entrepreneur Star, 2016 Medical Blockchain Top Award, 2017 Innovation Gold Award, as well as 2017 Meet Neo Star. In 2014, Michael founded CoolBitX, a blockchain security company that presented the world’s first mobile hardware wallet, the CoolWallet S, which reset the world’s expectations of a hardware wallet – offering unparalleled ease of use with best-of-industry security. With current valuation exceeding one billion Taiwan dollars, CoolBitX has sold over 100,000 wallets worldwide under Michael’s leadership.

Archives: team-member

member news and reviews

Om Kundu is the founder of InSpirAVE, and its flagship platform has been cited as revolutionary in empowering consumers with end-to-end access to discover and save more faster for their aspired purchase goals and experiences and named Top Fintech Forward Company To Watch by AMERICAN BANKER and BAI. By multiplying savings, InSpirAVE’s proprietary digital technology ensures that aspired purchases — including those that may have been out-of-reach otherwise — are discovered and fulfilled for life’s special moments, without debt.

InSpirAVE was most recently cited in Top-100 for 2018 Startup of The Year by the CTA and Tech.Co. and elicited consistent critical acclaim from leading forums incl. Finovate, EFMA, et.al.: Its #SaveForWhatMatters mission — in engendering a sustainable foundation for retail consumption—has been oft-cited across the industry, including recognition as a presenting company at ‘South by Southwest’.

Eric Griego is the Co-Founder and CEO of Betterfin. Previously as the Product Manager of AI & Graph at Radius he helped build the largest graph of commercial data. As the Product Manager of Decision Science at OnDeck Capital he helped build alternative credit models. He has a technical background in Data Science and Engineer as a Research Analyst in Credit for Goldman Sachs.

Over 20 years of startup, marketing, and business experience. Have founded a computer manufacturer, blockbuster marketing firm with over 30,000 clients from scratch and a global risk management company, servicing some of the largest companies on the planet. I have appeared before just about every type of legal jurisdiction in the country, have given expert testimony on major national investigations and have worked with a Federal Cyber Task Force for several years, advising on a high level, national matters. I am recognized as an expert in payments, security and data analysis as well as have worked with #Blockchain technology for over 10 years. I have spoken at NYU and other universities and continue to maintain strong ties to academia, payments and security matters. Don’t be afraid to ask, the worst I can do is say no.

Sameer Gulati

Sameer’s track record designing many of the world’s leading ERP and financial billing systems equipped him with the knowledge and desire to found Ordway. As one of the first Product Managers at Zuora, Intacct, and Workday, to product leadership at First Data, Sameer developed a deep understanding of the heartbeat of a business – billing and finance. An entrepreneur at heart, Sameer is also an active angel investor including investments in UrbanStems, Social Tables, TrackMaven, and Advantia Health. Throughout the excitement, strains, and challenges of building enterprise-level products, he constantly reminds his colleagues to “win or learn.

Carlos is a serial technology entrepreneur, investor, and frequent speaker at technology, innovation and entrepreneurship forums. Previous to AI8Ventures, Carlos Co-Founded and served as Executive VP at Sm4rt Corp, a holding company that included Sm4rt Security Services (Cyber Security Operation Centers), Sm4rt Predictive Systems (Artificial Intelligence Card Fraud Prevention Technologies) and Sm4rt Game Studios (Videogames). With Sm4rt he created the Premier Cyber Security and InfoSec compliance firm in the region, which ultimately was acquired by KIO Networks, the largest Information Technology Services Enterprise in Latin America. A Mexican bank consortium (E-Global) acquired the fraud prevention venture.

Mike Alfred

Mike is Co-Founder and CEO of Digital Assets Data Inc. He is responsible for the strategic vision and leadership of the company.

Previously, Mike was the Co-Founder and CEO of BrightScope, Inc., which was acquired by Strategic Insight in 2016. He is a prolific investor in public and private companies and sits on the board of directors of Hohm Inc and Crestone Group LLC.

Mike received his bachelor’s degree from Stanford University.

Timo Dreger

Timo Dreger is a FinTech/ InsurTech and Venture Capital expert, speaker and author. Timo shares his experiences and knowhow as key-note speaker, panelist and moderator around the world. Furthermore he is consistently ranked as one of the leading FinTech and InsurTech Influencer worldwide.

Timo Dreger is a Strategy & IR Manager at mybucks, the leading FinTech company in Sub-Saharan Africa with currently operating 5 banks and 8 MFIs, in excess of 1.5 million customers and over 2.1 million loans issued with a value of EUR 390 million in less than 5 years since inception.

Brian Kaas

Brian Kaas is president and managing director of CMFG Ventures, LLC and oversees all aspects of its venture capital program. Additionally, Kaas serves as the vice president of Corporate Development at CUNA Mutual Group. He is responsible for sourcing, evaluating and executing a broad range of strategic transactions for the organization. He also serves as a board member for several financial technology start-up companies. Kaas joined CUNA Mutual Group in 2012.

Alex is a financial expert specializing in investing and advising throughout the full lifecycle of companies from early stage to truly global institutions. Starting his career as an investment banker at the Bank of Montreal, Alex led multiple projects and teams across Capital Markets, including in Fintech, MA, and Financial Institutions. Alex helped lead the charge on several of Capital Market’s early blockchain initiatives and was recognized as a leader within the Investment Bank. Alex left BMO in early 2018 to co-found Bicameral Ventures, an innovative Venture Capital Fund focused on taking positions in exceptional early stage projects developing real-world business models on top of the Aion platform. Since founding Bicameral Alex has spoken at CoinAgenda Europe, CoinAgenda Global, Blockchain Solutions World, FiNext Con, and Fireside 2018.