In today’s digital era, online fundraising has become a vital tool for charities seeking to reach a broader audience and maximise their impact. While technology offers unprecedented opportunities, it also presents unique challenges in terms of compliance and governance. For charities embarking on this digital journey, working with a specialised charity law firm can provide the necessary guidance to navigate these complex waters. Understanding the evolving landscape of charity law is crucial for ensuring that your organisation not only thrives but also operates within the legal frameworks. Here, our charity experts will provide the necessary guidance you’ll need to safely navigate these complex waters. Understanding Charity Law in a Digital Context The rapid advancement of technology has necessitated a re-evaluation of traditional charity laws to accommodate online fundraising activities. It is imperative for charities to comprehend how these digital changes impact their legal obligations. While the principles of transparency, accountability, and integrity remain constants, their application in a digital setting requires careful consideration. Charitable organisations must ensure that they comply with both national and international regulations when fundraising online. This includes understanding data protection laws, digital marketing guidelines, and cross-border donation rules. Failure to adhere to these regulations can result in legal repercussions and damage to an organisation’s reputation. Key Elements of Online Fundraising Compliance When engaging in online fundraising, one must be diligent about compliance. Here are several critical components: By focusing on these areas, charities can enhance their compliance posture and build trust with their donors. Challenges in Governance for Digital Fundraising Governance in the digital age presents its own set of challenges. As the landscape of online fundraising evolves, so too must the governance structures within charities. These structures must be robust enough to oversee digital activities and ensure compliance with pertinent laws. It is also essential for charity boards to possess a deep understanding of digital tools and platforms. Investing in training and resources can help board members make informed decisions and effectively manage risks associated with online fundraising. Resources such as this comprehensive guide to online fundraising can prove invaluable. Image source: Pexels[f2] Effective governance requires a proactive approach to anticipate challenges and adapt to new developments in charity law. This ongoing process ensures that charities remain compliant and can continue to focus on their mission without legal distractions. In the next section, we will explore further intricacies of online charity governance. Adapting to Legal Developments in Digital Fundraising In the rapidly changing digital landscape, staying abreast of legal developments is vital for any charity engaged in online fundraising. Legislative updates can occur frequently, influenced by technological advancements and emerging challenges. It is therefore essential for organisations to keep their policies and procedures updated to reflect the latest legal standards. One effective way to manage this is through regular training sessions for staff and board members. These programmes should focus on new legal requirements, technological innovations, and best practices in digital fundraising. By fostering an organisational culture of continuous learning, charities can remain agile… Continue Reading Charity Law in a Digital Age: Compliance and Governance for Online Fundraising

Category: Blog

The ever-evolving landscape of workplace legislation continues to impact how businesses operate, particularly in the fintech sector. One of the most significant changes in recent years is the introduction of the Worker Protection Act 2023. Understanding this new legislation is crucial for fintech employers aiming to ensure compliance and foster a supportive work environment. Here, our expert team will dive into the details of the Worker Protection Act and ascertain just what it means for your fintech business. Read on for tips, tricks and clever hacks to maximise your return from this new legislation. Key Elements of the Worker Protection Act 2023 The Worker Protection Act 2023 introduces various measures designed to enhance employee rights and protections. As a fintech employer, there are several critical aspects you need to understand: Enhanced Workplace Protections This act strengthens protections against workplace harassment and discrimination, extending coverage to contractors and gig economy workers. The onus is on employers to ensure a safe and respectful workplace for all employees. Failure to comply could lead to substantial legal repercussions. Employers should review their current policies and practices to ensure they align with the new standards. It’s not only about reacting to incidents but also about preemptively creating an environment that discourages any form of discrimination. Impact on Pregnant Workers Part of the legislative effort builds on advancements like the Equality Act 2010 in terms of protections for expecting employees. Employers must provide reasonable accommodations for pregnant workers, ensuring that their roles can be performed without undue hardship. This could include modified tasks or more flexible working hours. Compliance Challenges for Fintech Employers The dynamic nature of the fintech industry, which often involves a diverse workforce including remote workers, presents unique challenges in implementing the Worker Protection Act 2023. To effectively navigate these changes, consider the following: Furthermore, aligning business practices with the latest UK statutory requirements is imperative. This means staying informed about any amendments and ensuring that HR and legal teams are prepared to adjust internal policies accordingly. Image source: Pexels[f2] International Comparisons and Their Influence The Worker Protection Act 2023 is not an isolated development. Internationally, similar legislation is being enacted to safeguard workers in diverse industries, including fintech. Understanding how these global trends can influence UK legislation is essential for employers aiming to stay ahead of the curve. For instance, look at recent legislative changes such as the Colorado Worker Protection Act. This act highlights the global trend towards stronger employee protections, providing valuable insights for UK fintech companies. By examining these international norms, you’ll be better equipped to anticipate future regulatory shifts and adapt accordingly. Adapting to a Global Workforce Fintech companies often operate on a global scale, necessitating an understanding of diverse legal landscapes. A thorough comprehension of international worker protection laws will assist in managing a multinational workforce effectively. This includes implementing practices that comply with both local and foreign regulations. Furthermore, adopting a proactive approach in tackling workplace discrimination and harassment serves as a competitive advantage. It enhances… Continue Reading Worker Protection Act 2023: What Every Fintech Employer Needs to Know

Navigating through financial difficulties can be daunting, particularly when juggling multiple debts. With the rise of fintech innovations, solutions like an individual voluntary arrangement (IVA) have become increasingly accessible and understandable for individuals seeking relief from overwhelming financial burdens. An individual voluntary arrangement is a formal and legally binding agreement between you and your creditors to pay back debts over a set period. This arrangement can provide a lifeline by freezing interest and stopping creditor pressure, thereby allowing you to regain control of your finances. Here, our experts will jump into exploring what IVAs mean for fintech, and how you might be able to utilise them to your benefit. Understanding the Basics of IVAs An IVA is designed to offer a structured plan tailored to an individual’s specific financial situation. This debt solution is particularly beneficial if you have a regular income and a significant amount of unsecured debt. The primary aim of an IVA is to enable you to make manageable payments while ensuring creditors receive a portion of what they are owed. Key Features of an IVA Some essential aspects of an IVA include: The Role of Fintech in Debt Solutions In recent years, fintech has revolutionised how individuals approach debt management, including IVAs. Fintech platforms provide transparency and flexibility, making it easier for you to understand and manage your financial commitments. These platforms utilise advanced technology to offer personalised advice, manage payments, and keep track of debts in real-time. Advantages of Fintech in IVA Management The integration of fintech into debt solutions provides several benefits: As you explore options for debt relief, it is crucial to be aware of potential pitfalls and ensure that any service provider, fintech or otherwise, operates under the appropriate regulatory frameworks to protect your interests. For more information about regulatory compliance, refer to the IVA Protocol 2021. How to Set Up an IVA Embarking on the journey of setting up an IVA requires careful consideration and the right guidance. Here is a step-by-step guide to help you through the process: 1. Seek Professional Advice Before proceeding, it is advisable to consult with a licensed insolvency practitioner who can assess your financial situation and recommend whether an IVA is the most suitable option for you. This professional will provide a realistic assessment of your finances and explain the implications of entering an IVA. 2. Proposal Preparation The insolvency practitioner will help draft a proposal for your creditors. This document outlines your financial situation, the proposed payment plan, and how it will benefit both you and your creditors. It is crucial that this document is comprehensive and accurate, as it forms the basis upon which creditors will decide whether to accept the IVA. 3. Creditor Meeting and Approval Once the proposal is ready, a meeting with your creditors is convened. For the IVA to be approved, creditors who hold at least 75% of the debt value need to agree. If approved, the IVA becomes legally binding, providing you with protection from further legal action… Continue Reading Individual Voluntary Arrangements Explained: A Fintech Perspective on Debt Solutions

A Complete Guide to Cancelling or Withdrawing Udyam Registration

A Complete Guide to Cancelling or Withdrawing Udyam Registration

The Fintech Frontier: Trailblazing Innovations of the Past Year

The fintech industry has undergone a whirlwind of change over the last 12 months, cementing its position as an industry that is growing rapidly and reshaping the financial landscape. From advancements in digital payments to the importance of decentralized finance (DeFi), the fintech sector has witnessed many innovations that will have a huge impact on consumers and businesses. Rapid growth in the adoption of mobile wallets and contactless payments. Digital Payment Solutions Digital payment solutions are becoming ubiquitous due to the COVID19 pandemic and the need for uninterrupted communication, with technology companies such as Apple, Google and Samsung expanding their wallets on the platform. This change not only improves the convenience and security of everyday shopping, but also paves the way for the integration of instant buy, pay by one (BNPL) options, allowing customers to split payments across management. The past year has seen an increase in the use of digital assets, with major financial institutions and businesses taking advantage of blockchain technology. This has led to the growth of userfriendly crypto wallets, trading platforms, and trading apps that make it easier for retailers and companies to explore the intricacies of the crypto ecosystem. Significant progress has also been made on inclusivity and accessibility. Innovative banks and neobanks that use technology to provide affordable and customer friendly financial services to underserved and underserved communities are at the forefront of this movement. From seamless mobile banking to personal financial planning tools, the fintech revolution is helping individuals and small businesses manage their financial future. Fusion (ML) for various financial applications. From automated investment advisors to fraud detection systems, advanced technologies are enabling fintech companies to deliver more personalized, efficient and secure financial services. This trend must continue, with the potential to change the way we manage our money and make smart financial decisions. As advances continue in areas such as open banking, arts finance and sustainable finance, the financial landscape will become more connected, personal and greener than ever before. By embracing these new trends, fintech companies are paving the way for a more integrated, efficient and profitable financial ecosystem that benefits people and businesses. The fintech landscape has always been a hotbed of innovation, with technology continuously reshaping how we think about and engage with financial services. The past year has been no exception, marked by groundbreaking advancements and transformative trends. Here, we explore some of the most trailblazing fintech innovations that have emerged over the last 12 months. 1. Decentralized Finance (DeFi) Expansion Decentralized Finance, or DeFi, has continued its meteoric rise, disrupting traditional financial systems with its promise of a permissionless and open financial ecosystem. Over the past year, we’ve seen DeFi protocols amass billions in total value locked (TVL), reflecting growing trust and adoption. Innovations such as automated market makers (AMMs), yield farming, and cross-chain interoperability have significantly enhanced the DeFi space, making it more accessible and versatile. 2. Central Bank Digital Currencies (CBDCs) Central Bank Digital Currencies have moved from theoretical concepts to pilot projects and even implementations. Countries like China, with its Digital Yuan, and the Bahamas, with the Sand Dollar, have led the charge, demonstrating the potential of CBDCs to enhance payment systems, increase financial inclusion, and provide more efficient monetary policy tools. The exploration of CBDCs by major economies signals a pivotal shift towards digital currencies on a national and global scale. 3. Embedded Finance Embedded finance has taken center stage, allowing non-financial companies to offer financial services directly within their platforms. This trend has been particularly evident in e-commerce, ride-sharing, and gig economy platforms, where companies integrate payment processing, lending, and insurance products seamlessly into their user experiences. By embedding financial services, businesses can provide a more holistic and convenient customer journey while opening new revenue streams. 4. Artificial Intelligence and Machine Learning AI and machine learning have become indispensable tools in fintech, driving innovations in areas such as fraud detection, credit scoring, and personalized financial planning. Over the past year, we’ve seen more sophisticated AI algorithms capable of analyzing vast datasets to uncover patterns and insights that human analysts might miss. These advancements have led to more accurate risk assessments, better customer service through AI-driven chatbots, and enhanced user experiences with personalized financial advice. 5. RegTech Solutions Regulatory Technology (RegTech) has gained momentum as financial institutions seek to navigate the complex and ever-changing regulatory landscape. Innovations in RegTech over the past year include advanced compliance monitoring systems, automated reporting tools, and blockchain-based solutions for regulatory transparency. These technologies help firms reduce compliance costs, minimize regulatory risks, and ensure adherence to global standards. 6. Green Fintech Sustainability has become a focal point for fintech innovation, with green fintech emerging as a significant trend. Companies are developing financial products that promote environmental sustainability, such as green bonds, carbon credit trading platforms, and sustainable investment funds. Additionally, fintech firms are leveraging blockchain to enhance transparency and traceability in supply chains, ensuring that investments and transactions align with environmental, social, and governance (ESG) criteria. 7. Buy Now, Pay Later (BNPL) Evolution The Buy Now, Pay Later (BNPL) model has surged… Continue Reading The Fintech Frontier: Trailblazing Innovations of the Past Year

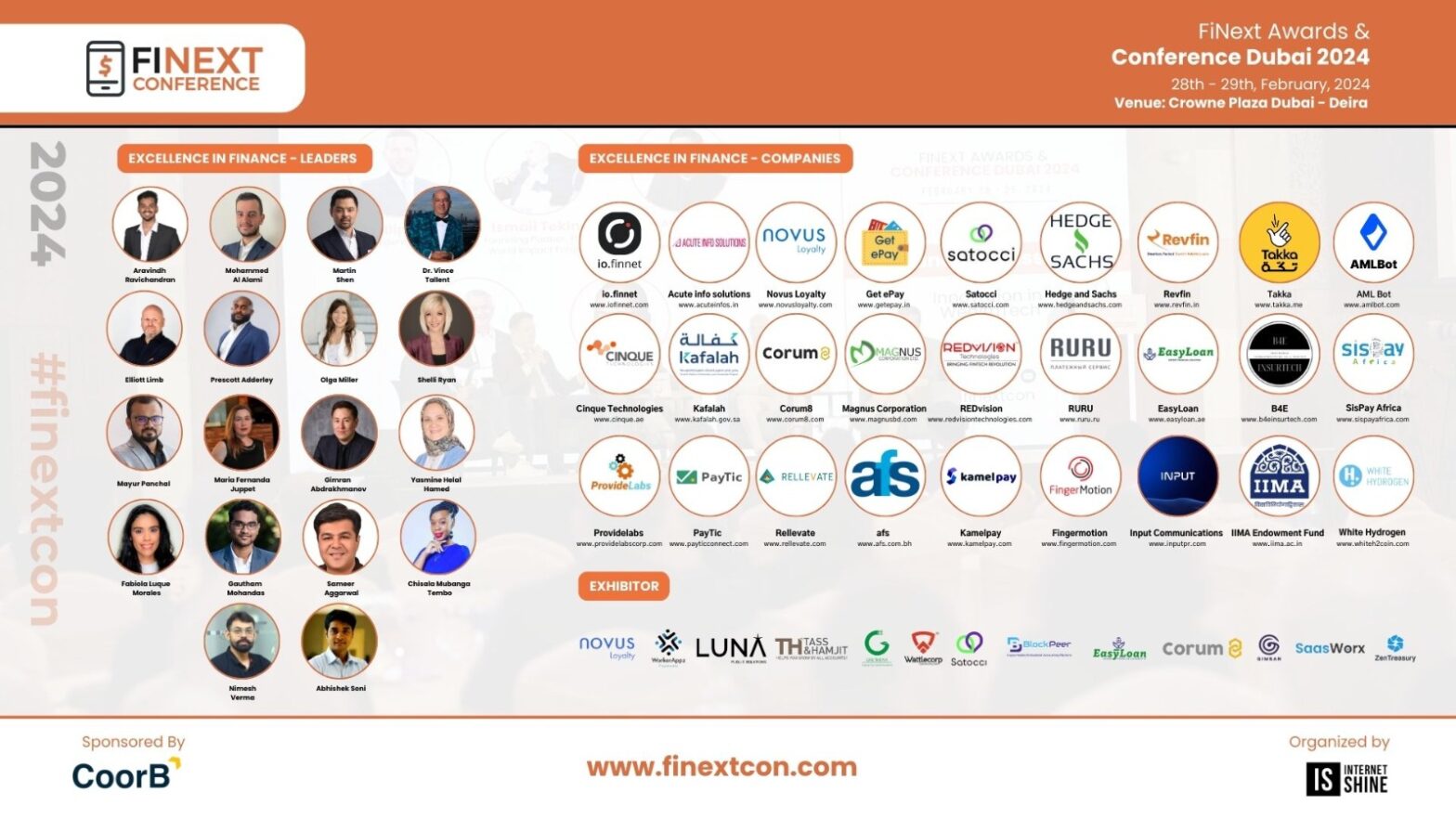

FiNext Conference 2024: Successfully Concludes 6th Edition in Dubai

The FiNext Conference, held in the vibrant city of Dubai on February 28th and 29th, 2024, servedas a dynamic platform for finance and technology innovators to converge and explore the futureof financial services. With CoorB as the proud sponsor, the event witnessed thought-provokingdiscussions, insightful presentations, and networking opportunities galore. Attendees from aroundthe globe engaged in conversations surrounding emerging trends, disruptive technologies, andstrategies to drive growth in the ever-evolving financial landscape. From blockchain to fintechstartups and traditional banking, FiNext Dubai 2024 showcased the intersection of finance andtechnology, paving the way for transformative advancements in the industry.InternetShine Corporation marked the third consecutive occurrence and the 6th edition of theFiNext Awards and Conference in Dubai. This distinguished event pays homage to theoutstanding achievements of entities and individuals in traditional finance and FinTech. With astrong emphasis on fostering interaction, innovation, networking, and talent showcase, FiNextcontinues to redefine excellence in the finance industry. Sponsored by CoorB: Pioneers in Digital Finance CoorB, the proud sponsor of the FiNext Conference, specializes in digital finance, providinginnovative solutions with a focus on process automation, user experience enhancement, andadvanced data analytics. Leveraging extensive industry expertise, CoorB helps achieveoperational excellence, future-proof IT investments, and ensures a competitive edge in the ever-evolving finance industry. Exhibitors at FiNext Conference: The conference boasts an impressive line-up of exhibitors, including:CoorB- CoorB is a professional services company specializing in Strategy and Consulting,Technology, and Managed Services. We work with banks and non-banking financial institutionsto design and implement innovative growth models; we provide highly qualified expertisespanning business strategy, advanced technology, and effective program management; we deliverfuture-ready technological solutions that overcome legacy limitations; we enhance organizationalagility and ensure technology serves the business goals. Our swift resource mobilization acrossdisciplines and unique approach to problem-solving enable us to achieve meaningful results withunparalleled speed.Luna PR – Luna PR is a global marketing and PR agency focusing on blockchain and fintech,space tech, emerging tech, medtech, e-sports and green tech.We work with events, startups, andbusinesses to bring the right exposure to your brand, increase awareness and reputation inmarkets worldwide. A division of Luna Management, our diverse and experienced team combinestheir knowledge in technology and communication to provide a customized yet simple plan to suiteach client’s needs. Tass & Hamjit – TASS AND HAMJIT is a professional services firm providing accounting,audit, business consultancy and advisory services to private, public enterprises and high net-worthindividuals. With a commitment to exceeding expectations, TASS AND HAMJIT offerscustomized solutions to clients of all sizes in the Middle East Asia and India. We are a team ofChartered Accountants, Finance Experts, Business Developers and CEOs each one of whom havean exciting exposure to some of the most challenging tasks in their respective fields. All theseprofessional power is merged into TASS AND HAMJIT to serve the best to our clients throughquality relationships and global standard services.Gimran & Co- Gimran & Co, under Gimran Abdrakhmanov’s leadership, is dedicated tofostering the growth of businesses through comprehensive financial solutions. As the CEO,Gimran spearheads a team committed to excellence and innovation in the financial industryEasy Loan Financing… Continue Reading FiNext Conference 2024: Successfully Concludes 6th Edition in Dubai

Sourabh Sahay, Co-Founder of Yoeki Soft Private Limited, is honored with an award for excellence in finance and banking.

Vishwa Sourabh, a visionary leader and Co-Founder of Yoekisoft, is set to showcase groundbreaking solutions at the prestigious FiNext Conference in Dubai. With an illustrious career spanning leadership roles at tech giants such as Meta (Facebook) and Amazon, Sourabh brings a wealth of experience and a proven track record of driving transformative change in the technology landscape. About Sourabh Sahay As Senior Leader in the ML Infra space at Meta, Sourabh played a pivotal role in laying the groundwork for ML infrastructure responsible for 98% of Meta’s revenue. His tenure as Engineering Leader at Amazon saw him spearheading operations and refunds management for global ecommerce operations. Sourabh’s contributions to Expedia Group, particularly in Destination Services and Expedia Rails framework, further underscore his expertise in driving innovation and operational excellence. In addition to his corporate achievements, Sourabh is a seasoned entrepreneur, having successfully founded and scaled up a profitable startup in ERP, retail banking, and industrial automation domains. Under his leadership, the startup expanded to over 100 employees, catering to diverse industries including fintech, oil and gas, manufacturing, telecom, and retail. “Yoekisoft is committed to revolutionizing the financial services industry through innovative technology solutions,” said Vishwa Sourabh, Chief Business Officer & Co-Founder of Yoekisoft. “Our mission is to empower organizations to streamline operations, reduce costs, and enhance customer experiences. I am thrilled to showcase our transformative products, including zipNACH, at the FiNext Conference and collaborate with industry leaders to drive positive change.” Yoekisoft’s flagship product, zipNACH, is a cloud-based solution designed to streamline and automate the NACH mandate registration process for banking and fintech institutions. By providing pre-populated fields, real-time validation, and seamless API integration, zipNACH enables businesses to standardize operations, reduce errors, and improve efficiency in recurring debt collection. “zipNACH represents our commitment to delivering innovative solutions that address the evolving needs of the financial industry,” added Sourabh. “We are dedicated to empowering businesses to thrive in today’s dynamic market landscape by leveraging cutting-edge technology and fostering collaboration.” To learn more about Yoekisoft and its innovative solutions, visit Yoekisoft.For more information about zipNACH, visit zipNACH. About Yoekisoft: Yoekisoft is a leading provider of IT solutions, specializing in delivering innovative products and services to the financial services industry. With a focus on driving efficiency, scalability, and value creation, Yoekisoft empowers organizations to achieve their business objectives and stay ahead in today’s competitive market. About Finext Conference: The FiNext Conference 2024, held on February 28th and 29th at the esteemed Crowne Plaza in Deira Dubai, emerged as a hallmark event celebrating the intersection of finance and technology. This premier gathering brought together visionaries, industry leaders, innovators, and disruptors from around the globe to explore, collaborate, and inspire.

“Shaping Tomorrow: Innovations in Open Banking Transactions and the Future of Payments”

Mr. Amitabh Tiwari, a digital innovation specialist and corporate diplomat, assumes the role of President & Group CEO of Infotouch Technologies, a leading Digital and IT Innovation Company. With a distinguished career spanning entrepreneurship and intrapreneurship in the IT and digital innovation industry, Tiwari has played a pivotal role in transforming Infotouch Technologies into an international business arcade since its inception in 2006. “As an entrepreneur and intrapreneur, I am deeply committed to driving innovation and fostering collaborations in the digital landscape,” says Tiwari. “Infotouch Technologies is poised to lead the way in digital transformation, and I am honored to lead the company into its next phase of growth and success.” Future of Payments In the ever-evolving landscape of financial technology, banking transactions and the future of payments are at the forefront of innovation. The way we handle money is undergoing a radical transformation, driven by advances in technology, changing consumer expectations, and regulatory developments. This blog will explore the current state of banking transactions, emerging trends, and what the future holds for payments. The Evolution of Banking Transactions Traditionally, banking transactions were conducted in person, with customers visiting their local branch to deposit checks, withdraw cash, or transfer funds. The advent of the internet and mobile technology revolutionized this process, making it possible to perform almost any banking task online or via a smartphone. Today, digital banking is the norm, with customers expecting seamless, instant access to their accounts. Key Milestones in Banking Transactions Emerging Trends in Payments As technology continues to advance, new trends are shaping the future of payments. Here are some of the most significant developments: 1. Digital Wallets and Mobile Payments Digital wallets, such as Apple Pay, Google Wallet, and Samsung Pay, are becoming increasingly popular. These platforms store users’ payment information securely and allow for fast, contactless transactions using smartphones or wearable devices. The convenience and security of digital wallets are driving their adoption, particularly among younger consumers. 2. Cryptocurrencies and Blockchain Cryptocurrencies like Bitcoin and Ethereum are challenging traditional banking systems by offering decentralized, peer-to-peer transactions. Blockchain technology, which underpins cryptocurrencies, provides a secure and transparent way to record transactions. While the mainstream adoption of cryptocurrencies is still evolving, they hold the potential to disrupt traditional payment systems and offer new opportunities for innovation. 3. Biometric Authentication Biometric authentication, including fingerprint scanning, facial recognition, and voice recognition, is enhancing the security of banking transactions. By reducing reliance on passwords and PINs, biometrics provide a more secure and user-friendly way to authenticate transactions, helping to prevent fraud and identity theft. 4. Real-Time Payments The demand for real-time payments is growing, with consumers and businesses expecting instant transaction processing. Innovations like the Faster Payments Service (FPS) in the UK and the Federal Reserve’s FedNow service in the US are making real-time payments a reality. These systems allow for immediate fund transfers, enhancing cash flow and improving the overall efficiency of financial transactions. 5. Open Banking Open banking initiatives, which promote the sharing of financial data… Continue Reading “Shaping Tomorrow: Innovations in Open Banking Transactions and the Future of Payments”

“Unveiling the Future: The Ascendancy of Real-World Assets in the Decade of DeFi”

Alina Krot, a seasoned finance professional with over five years of experience at a prominent financialinstitution, is set to represent 10101.art at the upcoming FiNext Conference. As the project head of10101.art since 2022, Alina has been instrumental in leading a team of art, software development, andlegal experts to revolutionize the global art market through blockchain solutions. 10101.art is not just an ordinary art marketplace; it’s a groundbreaking platform that bridges the classicart market with modern technology. Through art tokenization, 10101.art allows individuals to purchaseownership of renowned artworks by world-famous artists such as Banksy, Warhol, Picasso, Dali, andmore. Alina Krot’s participation in the FiNext Conference underscores her commitment to advancinginnovation within the finance and art sectors. With her extensive background in finance and herleadership role at 10101.art, Alina brings a wealth of knowledge and expertise to the conference. “I am honored to represent 10101.art at the FiNext Conference,” says Alina Krot. “Our platform aims todemocratize access to art collecting opportunities and reshape the way people engage with the artmarket. I look forward to sharing our vision and insights with fellow industry professionals at theconference.” The FiNext Conference provides a unique platform for thought leaders, innovators, and industry expertsto come together and discuss the latest trends and developments in finance, technology, andentrepreneurship. Alina’s participation will contribute to the conference’s mission of fosteringcollaboration and driving innovation across various sectors. About Alina Krot: Alina Krot is a seasoned finance professional with over five years of experience in high-risk investmentlending initiatives. Since 2022, she has served as the project head of 10101.art, leading the team inrevolutionizing the global art market through blockchain solutions. About 10101.art 10101.art is an innovative art tokenization platform that allows individuals to collect pieces of realpaintings by renowned artists. By leveraging blockchain technology, 10101.art aims to democratizeaccess to art-collecting opportunities and modernize the art market.About FiNext Conference: About FiNext FiNext is a global conference that brings together professionals and thought leaders from the financialand technology sectors. The conference aims to foster collaboration, share insights, and exploreemerging trends shaping the future of finance.

“Revolutionizing Capital Markets: Exploring the Blockchain Disruption”

Dr. Zayed Al Hemairy, Government Digital Transformation Expert,Speaking on (How Blockchain Will Reshape Capital Markets.) to IlluminateBlockchain Innovation at FiNext ConferenceDr. Zayed Al Hemairy, a distinguished expert in Blockchain, Project Management,NGOs, Innovation, and IT, is set to share his extensive expertise at the upcomingFiNext Conference. Leveraging 15 years of experience, Dr. Al Hemairy has been atthe forefront of driving digital transformation within government sectors, with a focuson optimizing innovation through cutting-edge technologies like Blockchain. Dr. Zayed Al Hemairy’s career is marked by a profound commitment to drivinginnovation and efficiency in government services. With a proven track record ofautomating services onto digital and blockchain platforms, his research furtherdelves into the intricate realm of government innovation optimization through theseadvanced technologies. “Participating in the FiNext Conference provides a valuable platform to discuss thetransformative potential of Blockchain and other innovative technologies in thegovernment sector. It is an exciting opportunity to exchange ideas, shareexperiences, and contribute to the ongoing dialogue on digital transformation,”expressed Dr. Zayed Al Hemairy. Beyond his role in driving digital transformation, Dr. Al Hemairy is a catalyst forentrepreneurial success. By mentoring startups and facilitating valuable connections,he contributes to the growth of innovative ventures in the tech industry. Hiscommitment to fostering a culture of innovation extends beyond his research andprofessional responsibilities. About Dr. Zayed Al Hemairy Dr. Zayed Al Hemairy is a seasoned expert with 15years of experience in Blockchain, Project Management, NGOs, Innovation, and IT.His focus on driving digital transformation within government sectors and optimizinginnovation through cutting-edge technologies showcases his commitment to shapingthe future of public services. About FiNext Conference FiNext Conference is a global platform that brings together professionals, thought leaders, andinnovators from the finance and technology sectors. The conference aims to foster collaboration,facilitate knowledge exchange, and explore the transformative potential of emerging trends in finance.