In today’s fast-paced, digital-first economy, the ability to accept credit and debit card payments on the go is crucial for small businesses. Whether you’re a food truck operator, a market vendor, or a service provider, mobile card processing solutions offer the flexibility and convenience needed to keep your business running smoothly and efficiently. Here, we explore some of the top mobile card processing solutions available to small businesses.

1. Square

Overview

Square is one of the most popular mobile card processing solutions on the market. Known for its ease of use and robust features, Square is a great option for businesses of all sizes.

Features

- Free Card Reader: Square offers a free magstripe reader to get you started.

- Affordable Rates: Transparent pricing with no monthly fees and a standard rate of 2.6% + 10¢ per transaction.

- All-in-One App: Manage payments, inventory, and customer relationships from a single app.

- Versatility: Accept payments via magstripe, chip cards, and NFC (contactless) payments.

Pros

- Easy to set up and use.

- Comprehensive point-of-sale (POS) system.

- No long-term contracts.

Cons

- Higher fees for certain types of transactions (e.g., keyed-in transactions).

2. PayPal Zettle

Overview

PayPal Zettle (formerly known as PayPal Here) is a strong contender for businesses already using PayPal for online transactions. It integrates seamlessly with PayPal, making it a convenient option for many.

Features

- Quick Setup: Start accepting payments within minutes.

- Competitive Rates: Charges 2.29% + 9¢ per transaction.

- Multiple Payment Options: Accepts chip cards, contactless payments, and magstripe.

- Integration with PayPal: Funds can be easily transferred to your PayPal account.

Pros

- Easy integration with existing PayPal accounts.

- Extensive support for various payment types.

- No monthly fees.

Cons

- Slightly higher transaction fees compared to some competitors.

- Limited advanced features compared to Square.

3. Clover Go

Overview

Clover Go offers a flexible and scalable mobile payment solution suitable for small businesses with varying needs. It’s part of the broader Clover POS ecosystem, which is known for its reliability and feature-rich services.

Features

- Portable Card Reader: Supports chip, contactless, and magstripe payments.

- Customizable: Integrate with various Clover apps to tailor the system to your needs.

- Real-Time Reporting: Access detailed sales reports and analytics.

- User-Friendly Interface: Simple and intuitive app for quick transactions.

Pros

- Integration with the Clover POS system.

- Scalable solutions for growing businesses.

- Strong analytics and reporting tools.

Cons

- Initial hardware cost.

- Monthly service fees may apply depending on the plan.

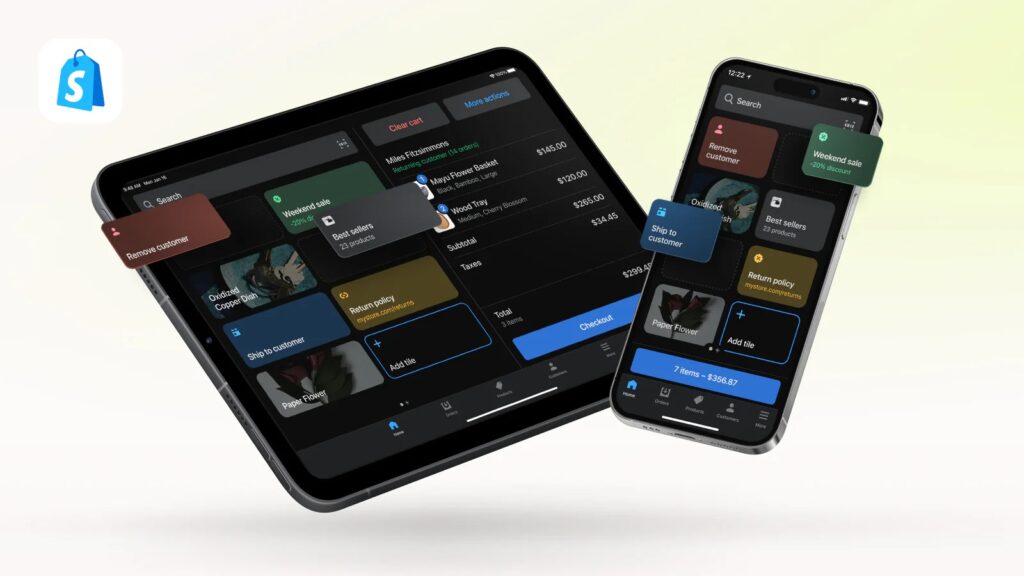

4. Shopify POS

Overview

Shopify POS is ideal for businesses that are already using Shopify for their e-commerce operations. It seamlessly blends online and offline sales, making it perfect for retailers with both a physical and online presence.

Features

- Integrated System: Syncs with your Shopify online store.

- Flexible Hardware: Use Shopify’s card reader or integrate with other hardware.

- Comprehensive Inventory Management: Track inventory across multiple locations.

- Detailed Analytics: Access powerful reporting tools to monitor sales performance.

Pros

- Seamless integration with Shopify’s e-commerce platform.

- Unified inventory and sales management.

- Supports a wide range of payment methods.

Cons

- Monthly fees can add up for small businesses.

- Requires a Shopify subscription.

5. SumUp

Overview

SumUp is a straightforward, no-frills mobile card processing solution that’s great for small businesses looking for a cost-effective option.

Features

- Low Transaction Fees: Charges a flat rate of 2.75% per transaction.

- Simple Setup: Easy to get started with minimal hardware.

- Multiple Payment Methods: Accepts chip, contactless, and magstripe payments.

- No Monthly Fees: Pay only per transaction.

Pros

- Very affordable with no monthly fees.

- Easy to use and set up.

- Reliable payment processing.

Cons

- Limited features compared to more comprehensive systems like Square or Clover.

- Basic reporting and analytics.

Conclusion

Choosing the right mobile card processing solution is crucial for the efficiency and growth of your small business. Each of the options listed above has its strengths and can cater to different business needs and scales. Square and PayPal Zettle offer excellent overall features and ease of use, Clover Go provides a scalable and robust system for growing businesses, Shopify POS is perfect for integrating online and offline sales, and SumUp is an affordable and straightforward choice. Evaluate your specific requirements, budget, and future plans to select the best solution for your business.