The digital revolution is transforming Africa’s financial sector, with numerous payment companies leading the charge. These companies are bridging gaps, fostering financial inclusion, and driving economic growth across the continent. Here’s a look at the top 10 payment companies making waves in Africa.

1. M-Pesa

M-Pesa, a mobile money service launched by Safaricom in Kenya, has become synonymous with financial inclusion. Since its inception in 2007, M-Pesa has enabled millions of unbanked and underbanked individuals to perform transactions, save money, and access credit. Its success has inspired similar services across the globe.

2. Flutterwave

Flutterwave, a Nigerian fintech company, provides seamless payment solutions for businesses in Africa and beyond. Founded in 2016, Flutterwave offers a robust platform that enables merchants to accept payments in various forms, including cards, bank transfers, and mobile money. Its innovative approach has earned it a spot among the top payment gateways in Africa.

3. Paystack

Paystack, also based in Nigeria, is a rapidly growing payment processing company. Acquired by Stripe in 2020, Paystack empowers businesses to accept online and offline payments easily. Its user-friendly interface and comprehensive suite of tools have made it a favorite among African entrepreneurs and SMEs.

4. Paga

Paga, another Nigerian fintech giant, focuses on simplifying payments and financial services for individuals and businesses. Established in 2009, Paga provides a wide range of services, including bill payments, money transfers, and merchant payments. Its extensive agent network has significantly boosted its reach across Nigeria.

5. Cellulant

Founded in 2003, Cellulant is a leading Pan-African payments company operating in multiple countries. With a mission to digitize payments across Africa, Cellulant offers a suite of solutions for consumers, businesses, and governments. Its flagship product, Tingg, is a one-stop digital payments platform that supports various transaction types.

6. Jumo

Jumo, a South African company, combines fintech and data science to provide financial services to underserved markets. Since 2014, Jumo has offered lending and savings solutions through partnerships with mobile network operators and banks. Its data-driven approach has enabled millions of Africans to access financial services previously out of reach.

7. Chipper Cash

Chipper Cash, founded in 2018, is a cross-border payments app operating in multiple African countries. Headquartered in San Francisco, Chipper Cash enables free peer-to-peer transfers and low-cost business transactions. Its rapid growth and innovative services have made it a key player in Africa’s digital payments landscape.

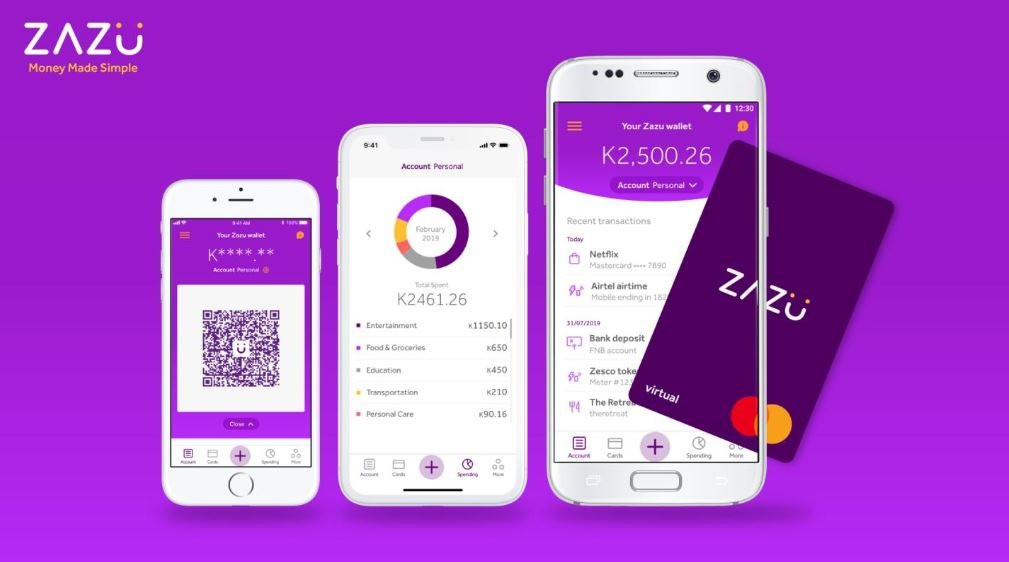

8. Zazu

Zazu is a Zambian fintech startup that aims to enhance financial literacy and inclusion through its digital wallet and financial management tools. Launched in 2015, Zazu offers a prepaid card and an app that allows users to manage their money, make payments, and track expenses, empowering individuals to take control of their finances.

9. Kuda Bank

Kuda Bank, a Nigerian digital-only bank, is revolutionizing banking in Africa with its no-fee, user-friendly banking services. Since its launch in 2019, Kuda has attracted a significant customer base by offering free transfers, savings plans, and budgeting tools. Its mobile-first approach resonates well with Africa’s tech-savvy youth.

10. Eversend

Eversend is a Ugandan multi-currency e-wallet that offers various financial services, including cross-border money transfers, currency exchange, and bill payments. Founded in 2017, Eversend’s mission is to provide affordable and accessible financial services to Africans, particularly those who are underserved by traditional banks.

Conclusion

These ten payment companies are at the forefront of Africa’s fintech revolution, driving financial inclusion and economic growth across the continent. By leveraging technology and innovative solutions, they are reshaping the financial landscape and providing millions of Africans with access to essential financial services. As these companies continue to expand and innovate, the future of payments in Africa looks brighter than ever.